“Apple Inc.’s business model focuses on the design and sale of high-quality, innovative products and services. Apple’s products hold a unique position in the market due to their aesthetic design, user-friendliness, high-quality construction, and strong brand image.

Here are some of Apple’s main products and services:

Hardware Products: Apple offers hardware products such as the iPhone (smartphone), iPad (tablet), Mac (personal computer), Apple Watch (smartwatch), Apple TV (digital media player), and AirPods (wireless earbuds). Software and Services: Apple develops a variety of software, including operating systems like iOS, iPadOS, macOS, etc. It also offers services like the App Store, Apple Music, iCloud, Apple Pay, etc. Digital Content and Subscriptions: Apple sells digital content such as music, movies, TV shows, books, apps, etc. It also provides subscription services like Apple Music, Apple TV+, Apple Arcade, Apple News+, etc. Apple’s business model is also characterized by the creation of an ‘ecosystem’ where these products and services complement each other. For example, iPhone users can buy apps from the App Store or listen to music on Apple Music. This encourages users to continually use Apple’s products and services, improving Apple’s profitability and customer loyalty.

Furthermore, Apple adopts a premium pricing strategy for its products. Reflecting the high quality of the products and the strength of the brand, Apple sets prices higher than those of competing products. This allows Apple to achieve high-profit margins and reinvest those profits into research and development and marketing. This supports Apple’s ongoing growth and innovation.

Apple’s Revenue, EBITDA, and Net Income

Apple is one of the most valuable companies in the world, known for its innovative technological products such as the iPhone, iPad, and Mac. It also provides software, services, accessories, networking solutions, digital content, and applications.

Looking at this graph, it is evident that revenue per share, EBITDA, and net income are all increasing significantly year by year. This upward trend reflects the success of Apple’s business model and strategy. Let’s look at these elements in more detail:

Product Innovation: Apple is known for its ability to develop new products and create new markets. The release of the iPod, iPhone, iPad, and Apple Watch were all critical moments that spurred significant growth in sales. High-Quality Products and Brand Loyalty: Apple’s products are known for their quality, design, and user experience. This has allowed them to build a strong brand and a loyal customer base that is happy to pay premium prices for their products. This contributes to high revenue per share. Expansion into Services: In recent years, Apple has significantly expanded its services division, with the App Store, Apple Music, iCloud, and more recently Apple TV+ and Apple Arcade. The services division provides a more consistent source of income than hardware sales and has higher profit margins. This shift could be contributing to the increase in EBITDA and net income. Efficient Supply Chain Management: Apple’s efficient supply chain management and production process ensure that the company can manufacture and sell large volumes of products, increase revenue, and maintain healthy profit margins. Share Buybacks: Apple has bought back its own shares, reducing the number of shares in circulation and increasing earnings per share. In conclusion, the year-over-year growth in Apple’s revenue per share, EBITDA, and net income is due to product innovation, brand strengthening, expansion into services, efficient operations, and financial strategies like share buybacks. This demonstrates the effectiveness of Apple’s business model and its ability to adapt to changing market conditions.

Apple’s Cash Flow Trends

Firstly, the blue line represents ‘Operating Cash Flow’, which indicates the cash flow generated from Apple’s primary products and services. From 1993 to 2022, operating cash flow generally shows an increasing trend. This demonstrates that Apple’s products and services attract high demand, resulting in a significant influx of cash into the company.

Next, the red line represents ‘Investing Cash Flow’. This shows the cash outflow when Apple invests in things like new product development or infrastructure improvements. This line mostly takes on negative values, indicating that Apple is making substantial investments to ensure the growth and sustainability of its business.

Lastly, the green line represents ‘Financing Cash Flow’. This shows the cash flow caused by Apple’s actions such as issuing or repurchasing shares, issuing or repaying debt, and paying dividends. This line also mostly takes on negative values, indicating that Apple is using a large amount of cash for paying dividends, repurchasing its own shares, or repaying debt.

From this analysis, it is clear that Apple’s strong business model generates a large amount of operating cash flow. A portion of this is used for investments to ensure growth and sustainability, and another portion is distributed as returns to shareholders.”

Apple’s Balance Sheet Trends

Apple Inc. generates its revenue by offering hardware products (such as iPhone, iPad, Mac, etc.) and a variety of software and services that complement them (such as iOS, App Store, Apple Music, iCloud, etc.). As sales of these products and services increase, total assets and current assets are also increasing. This suggests that the company is generating large cash inflows and using a portion of them for investments necessary for product development, marketing, infrastructure, and other business operations.

The blue line represents ‘total assets,’ which signifies the value of all assets owned by Apple. This includes cash, accounts receivable, inventory, fixed assets, and intangible assets. The increase in total assets indicates that Apple is selling profitable products and services and earning substantial profits.

The green line represents ‘equity,’ which shows the net asset value of the company, i.e., total assets minus liabilities. The stability of equity at a certain level suggests that Apple is reinvesting some cash to support the growth of its business.

The red line represents ‘current assets,’ which indicates assets that the company can liquidate into cash within a short period (usually within a year). The increase in current assets suggests that Apple holds sufficient cash and has the ability to meet short-term liabilities.

Finally, the purple line represents ‘liabilities,’ which shows the total amount of debt that Apple needs to repay. The increase in liabilities suggests that Apple is raising funds through borrowing and issuing bonds to support the expansion of its business.

From these results, it can be said that Apple’s business model is extremely successful. Its strong lineup of products and services generate high profits, and reinvesting these profits supports the growth and sustainability of the company. Additionally, the increase in liabilities indicates that Apple is willing to invest in the expansion and innovation of its business.

Performance by Apple Product

This bar graph shows the net sales per category in 2020, 2021, and 2022. The bars for each year represent iPhone, Mac, iPad, Wearables, Home and Accessories, Services, and Total net sales, in that order from the left.

iPhone: The iPhone segment includes sales from the iPhone product line. This segment has seen consistent sales growth over the past three years, with a 7% increase in 2022 compared to 2021. The increase in sales is mainly due to an increase in demand for iPhones. Mac: The Mac segment includes sales from the Mac product line. This segment has also seen consistent sales growth over the past three years, with a 14% increase in 2022 compared to 2021. The increase in sales is mainly due to an increase in demand for Mac computers. iPad: The iPad segment includes sales from the iPad product line. This segment saw a 8% decrease in sales in 2022 compared to 2021. The decrease in sales is mainly due to a decrease in demand for iPads. Wearables, Home and Accessories: This segment includes sales from products such as AirPods, Apple TV, Apple Watch, Beats products, HomePod mini, and accessories. This segment has seen consistent sales growth over the past three years, with a 7% increase in 2022 compared to 2021. The increase in sales is mainly due to an increase in demand for these products. Services: The Services segment includes sales from the company’s advertising, AppleCare, cloud, digital content, payments, and other services. This segment has seen consistent sales growth over the past three years, with a 14% increase in 2022 compared to 2021. The increase in sales is mainly due to an increase in demand for these services. From this, the following can be understood:

Importance of the iPhone: The iPhone accounts for a large portion of Apple’s sales and showed a growth of 7% in 2022. This indicates that the iPhone continues to be a major source of revenue for Apple, and its performance significantly impacts the company’s overall performance. Growth in Services: The services division showed a growth of 14%, indicating that Apple’s strategy to increase the profitability of services is paying off. The profit margin of the services division is extremely high at 71.7%, even when compared to the product division’s 36.3%. This indicates that Apple could further expand the services division to increase profitability. Steady growth in Mac and Wearables, Home, and Accessories: Both the Mac and the Wearables, Home, and Accessories divisions showed growth of 14% and 7% respectively. This indicates that these product lines continue to enjoy strong demand. Decrease in iPad sales: iPad sales decreased by 8%. This could indicate a decrease in demand for iPads or increased competition. These results indicate that Apple’s product portfolio is diverse, and each product line has a different impact on the overall performance of the company. Also, these data emphasize the importance of Apple continuing to focus on the development of new products and improvement of existing products.

Similarly, the progression of Apple’s gross margin is as follows:

This bar graph shows the gross profit of products and services in 2020, 2021, and 2022. Each bar for each year represents Products, Services, and Total gross margin, in that order from the left.

The graph above represents the gross margin rate of products and services, and the overall gross margin rate for each year in the form of a bar graph. The color is used to identify each category, and the colors match within the same category. It represents the products, services, and overall gross margin rate in that order from the left.

The gross margin rate is the gross profit divided by the sales, indicating the profitability of each category. From this graph, it is clear that the gross margin rate for services is the highest, with products and the overall gross margin rate being lower. The following can be inferred from the gross margin chart:

Difference in gross margin between products and services: The gross margin for products and services is significantly different, with products at 36.3% and services at 71.7% in 2022. This indicates that while the production and sale of physical products incur high costs, services can be provided at a relatively low cost, resulting in a high profit margin. Improvement in gross margin: Both products and services show an improvement in gross margin. This indicates that Apple has been successful in product and service pricing, cost management, and improving efficiency. Importance of services: Given the extremely high gross margin for the services division, it is suggested that by focusing on expanding the services division, Apple could potentially improve the overall profit margin. These pieces of information are useful for understanding Apple’s business model and profitability. The difference in gross margin between products and services indicates how Apple maximizes revenue and manages costs. Also, the improvement in gross margin indicates that Apple has been successful in improving efficiency and implementing pricing strategies.

Apple’s Performance by Region

The above graph illustrates the revenue for each region, while the graph below represents the operating profit for each region. Blue corresponds to the United States, orange to Europe, green to Greater China (including mainland China), red to Japan, and purple to the Asia-Pacific region (excluding Japan and China). By comparing the performance across these regions, we can observe growth or contractions.

From these graphs, we can analyze Apple’s regional performance and overall trends.

Revenue growth: All regions have seen an increase in sales from 2020 to 2022. This suggests that Apple’s products and services command strong demand globally. Largest market: The United States is the largest market, making the most substantial contributions in both revenue and profit. However, other regions also demonstrate steady growth. Fastest growth: The ‘Greater China’ region (including mainland China) has seen the fastest growth between 2020 and 2022. This implies that the Chinese market is a crucial growth engine for Apple. Operating profit: Operating profit has also grown in all regions. This suggests that Apple sells its products and services with high margins. Japanese market: Sales in the Japanese market have declined between 2021 and 2022. This could be due to market shrinkage, increased competition, or other regional factors. From these observations, it’s evident that Apple’s products and services have robust demand worldwide, especially showing rapid growth in the Chinese market. However, the decline in the Japanese market needs attention and may impact future business strategies. Overall, the strong growth in Apple’s sales and profits indicates that the company continues to offer competitive products and sustain a powerful brand presence.

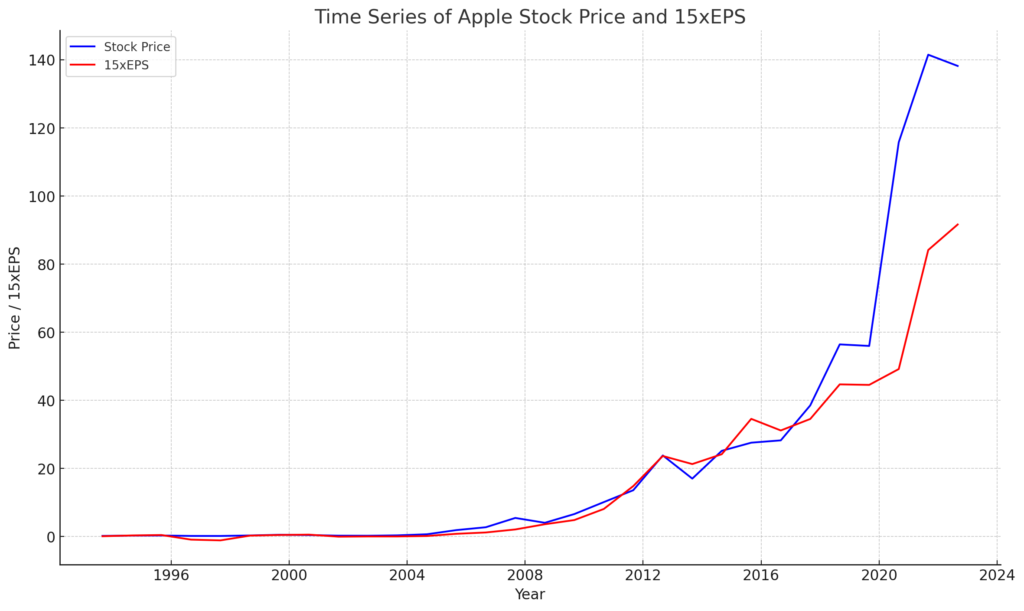

Apple’s Stock Price and Theoretical Stock Price

This graph illustrates the movement of Apple Inc.’s stock price alongside its theoretical stock price, which is 15 times its Earnings Per Share (EPS). This is a critical indicator of how the stock price correlates with Apple’s profitability (EPS). A multiple of 15 times the EPS is a common benchmark to evaluate whether the stock price is fair. If the stock price is above this line, it may indicate that the stock is overvalued. Conversely, if the stock price is below this line, it might suggest that the stock is undervalued.

Apple’s business model emphasizes designing and selling high-quality products and services. Key products include the iPhone, iPad, and Mac, all of which yield high profit margins. This allows Apple to achieve a high EPS, and an increase in EPS could potentially lead to a rise in the stock price.

Furthermore, Apple can set high prices for its products by leveraging astute marketing strategies and brand loyalty. This results in higher profits and further increases in EPS, which are likely contributing to the rise in stock price.

On the other hand, Apple’s stock price is also influenced by general market trends and investors’ expectations. For instance, the release of new products or upward revisions of earnings forecasts could boost the stock price, while economic downturns or a decrease in competitiveness could potentially push it down.

Looking at the graph, Apple’s stock price exceeds 15 times its EPS for most of the period, which might suggest that Apple’s stock is potentially overpriced. However, this isn’t necessarily a negative indicator. Market participants might be anticipating future growth for Apple, and that expectation could be reflected in the current stock price.

Please consider these factors and invest cautiously.